PH Statement of Assets Liabilities and Net Worth 2015-2025 free printable template

Show details

Revised as of January 2015 Per CSC Resolution No. 1500088 Promulgated on January 23, 2015SWORN STATEMENT OF ASSETS, LIABILITIES AND NET WORTH As of (Required by R.A. 6713) Note: Husband and wife who

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign saln form

Edit your saln form 2023 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your saln form download form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing saln form pdf download online

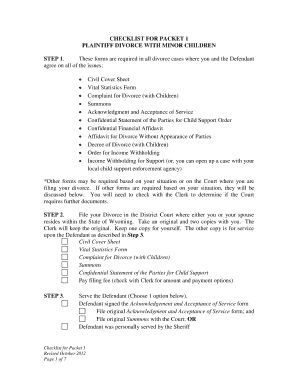

Follow the steps below to benefit from the PDF editor's expertise:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit saln form excel download. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out saln form 2024 pdf download

How to fill out PH Statement of Assets Liabilities and Net Worth

01

Obtain the PH Statement of Assets, Liabilities, and Net Worth form.

02

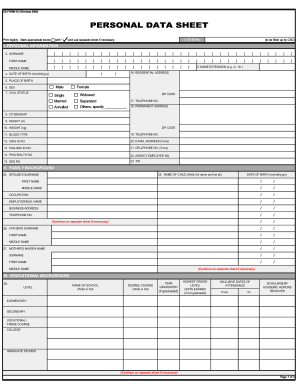

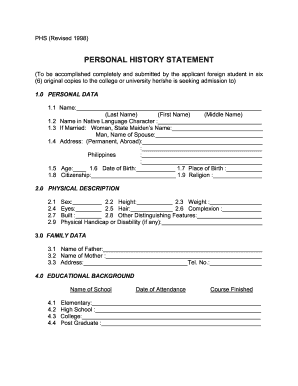

Fill in your personal information at the top of the form, including your name, position, and date.

03

List all of your assets in the assets section, including real estate, vehicles, cash, investments, and any other valuable properties.

04

Value your assets accurately and provide supporting documents if required.

05

Move to the liabilities section and list all your debts and obligations, including loans, credit card debts, and any other liabilities.

06

Calculate your total assets and total liabilities.

07

Subtract total liabilities from total assets to determine your net worth.

08

Review the document for accuracy and completeness.

09

Sign and date the form where indicated before submission.

Who needs PH Statement of Assets Liabilities and Net Worth?

01

Public officials in the Philippines are required to submit this statement to promote transparency.

02

Individuals seeking government employment may also need to provide this statement.

03

Business owners applying for loans or seeking investors may need to present their net worth.

04

Anyone undergoing financial audits or assessments might need to prepare this statement.

Fill

saln form word download

: Try Risk Free

People Also Ask about saln form editable

What is the purpose of SALN?

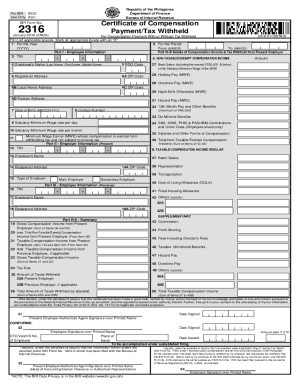

A Statement of Assets, Liabilities, and Net Worth (SALN) is an annual document that all government workers in the Philippines, whether regular or temporary, must complete and submit attesting under oath to their total assets and liabilities, including businesses and financial interests, that make up their net worth.

How do I download a SALN form?

Follow this simple guideline redact Saln form 2022 pdf download in PDF format online for free: Register and log in. Create a free account, set a secure password, and proceed with email verification to start managing your forms. Add a document. Make changes to the template. Get your paperwork accomplished.

How do I get a statement of assets and liabilities?

The formula is: total assets = total liabilities + total equity. Total assets is calculated as the sum of all short-term, long-term, and other assets. Total liabilities is calculated as the sum of all short-term, long-term and other liabilities.

What is the statement of assets liabilities and net worth?

It is a declaration of assets (i.e., land, vehicles, etc) and liabilities (i.e., loans, debts, etc), including business and financial interests, of an official/employee, of his or her spouse, and of his or her unmarried children under 18 years old still living in their parents' households.

What is the full form of SALN?

CONTENTS. This compilation of frequently asked questions (FAQs) on the Statement of Assets, Liabilities, and Net Worth (SALN) aims to capture the most common questions asked by government workers and the public on filling out and filing the SALN.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is download saln form?

Download Saln Form is a form used by individuals in the Philippines to declare their assets, liabilities, and net worth for the purpose of filing an Annual Statement of Assets, Liabilities, and Net Worth. This form is required to be submitted to the Bureau of Internal Revenue (BIR) every year and must be signed by the taxpayer.

Who is required to file download saln form?

In the Philippines, all government employees, including elected officials and members of the judiciary, are legally required to file a Statement of Assets, Liabilities and Net Worth (SALN) form annually.

How to fill out download saln form?

1. Download the salary form from your company website or from an online source.

2. Fill out the required information in the form, including your name, address, and Social Security number.

3. Enter your job title, rate of pay, and the dates of your pay period.

4. Include any deductions such as taxes, health insurance, or contributions to retirement accounts.

5. Enter any additional income you may receive, such as overtime pay or bonuses.

6. Verify all of the information you have entered is correct.

7. Sign the form and submit it to your employer.

What is the purpose of download saln form?

The purpose of downloading a salary form is to receive payment from an employer. It is a form used by employers to provide information to employees about their salary, wages, and other compensation. It is also used to calculate taxes, deductions, and other payroll-related items.

What information must be reported on download saln form?

The information that must be reported on a download SALN form includes the filer’s name, address, occupation, assets (including cash, real estate, stocks, and bonds), liabilities (including loans and credit accounts), and other sources of income (including business interests).

Where do I find saln downloadable form?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific saln editable form and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I make edits in saln form downloadable without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your saln form 2024 downloadable, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I create an electronic signature for signing my saln form pdf fillable in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your saln form 2024 editable and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

What is PH Statement of Assets Liabilities and Net Worth?

The PH Statement of Assets, Liabilities, and Net Worth (SALN) is a legal document required in the Philippines which provides a full disclosure of all assets, liabilities, and net worth of public officials and employees.

Who is required to file PH Statement of Assets Liabilities and Net Worth?

All public officials and employees in the Philippines, including elected officials, appointed officials, and employees of government agencies, are required to file the SALN.

How to fill out PH Statement of Assets Liabilities and Net Worth?

To fill out the SALN, individuals must accurately list all assets including real properties, personal properties, and financial investments, as well as all liabilities such as loans and obligations. The document must be signed and submitted to the appropriate government body or agency.

What is the purpose of PH Statement of Assets Liabilities and Net Worth?

The purpose of the SALN is to promote transparency and accountability among public officials and employees by requiring them to publicly disclose their financial interests and ensure that they do not engage in corrupt practices.

What information must be reported on PH Statement of Assets Liabilities and Net Worth?

The SALN must include information regarding the individual's real and personal properties, liabilities, business interests, and other financial interests, as well as a declaration of income received during the preceding year.

Fill out your saln form 2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Editable Saln Form is not the form you're looking for?Search for another form here.

Keywords relevant to saln form 2023 pdf download

Related to saln form excel download 2023

If you believe that this page should be taken down, please follow our DMCA take down process

here

.